To say that we are facing an uncertain future would be a major understatement. Over the past few months, it’s begun to seem likely that our path toward a stable post-COVID world won’t be as smooth as we all might have hoped. The ongoing war in Ukraine, in particular, is putting pressure on systems that were already struggling to cope.

And we can already see the consequences of this for the global economy. Inflation is hitting levels not seen in decades while stocks match the single-day declines of the early months of the pandemic.

This has understandably had a knock-on effect on the confidence of economists and those within the financial sector. The World Economic Forum’s recent Chief Economists’ Outlook report shows a big shift away from the optimism of late 2021. As recently as January, most expected the major economies to return to their pre-COVID growth paths by the end of this year. However, many economists have now revised their outlook downward, with Europe, in particular, looking likely to struggle.

So, what does all this mean for investors? It’s perfectly reasonable to feel some anxiety at the prospect of an extended economic downturn and the likelihood of more troubled times ahead. But there are always steps that investors can take to protect themselves in times like these.

As someone with extensive experience in the natural resources sector, one strategy in particular stands out to me: pivoting to gold as a way to mitigate risk within your investment portfolio.

And I’m not alone in turning to gold at a time like this. A range of major global banks and veteran investors are forecasting a substantial surge in the price of gold over both the medium and longer term, as people look to take advantage of gold’s status as a “safe haven” asset.

But why is gold so important when crisis strikes? And what are the tell-tale signs that gold may be about to surge?

In this post, I’ll try to answer those questions by looking at gold’s historic importance as a risk-limiting diversification tool, and explaining why, now more than ever, gold is an essential part of any portfolio during times of crisis.

A turbulent global outlook

Before we consider why gold has such importance as an asset during trying times, let’s look a bit more closely at what the coming year might hold for the global economy.

Unfortunately, it’s not a pretty sight. In late May, business leaders gathered in Davos for the first time since 2020, but it wasn’t quite the happy reunion they might have hoped for. According to Bill Winters, CEO of Standard Chartered, many of the conversations were focused on the likelihood of recession – with Winters himself putting it at 50/50.

And looking at the available data, you wouldn’t exactly want to bet against him. Inflation across the Eurozone hit 7.5% in April, while in the US it surged to a 41-year high of 8.5% in March, falling narrowly to 8.3% the following month. Real wages and consumer confidence have declined in tandem, while stocks are continuing to slide as companies revise their earnings projections downward – with the previously buoyant tech sector leading the decline.

In the US the signs are particularly dire, with the S&P 500 approaching bear market territory throughout May. As retailers begin to follow tech companies in reporting declining earnings, the overall trajectory for the world’s largest economy is not reassuring. And where the US goes, others are likely to follow.

Of course, much of this is the immediate result of the war in Ukraine. By disrupting global energy and food supplies, the war has strained and already weakened global economy and derailed the expected post-COVID resurgence.

But there are bigger forces in play, too. In my experience, it is important for investors to take a step back to review the full picture before deciding how to proceed in such challenging times. Focusing on a single cause – even something as significant as a war – can underestimates the potential for longer-term market risks and the substantial possibility of secondary shocks. The slowdown in China’s export growth, for instance, also had a significant impact in early May, as renewed lockdowns in major cities such as Shanghai took their toll.

But there are also signs that something more fundamental is happening to the global economy. Looking to the core inflation rate – that is, the inflation rate once the more volatile goods such as food and energy are removed – we can see that higher levels of inflation are, as JPMorgan’s Allan Monks puts it, “bleeding” from energy and goods into core services. This raises the prospect that any resolution to the current crisis may not have a significant dampening effect on rising prices and the erosion of purchasing power.

Ultimately, I believe that focusing on the immediate context of rising inflation may be taking too narrow a view. There are growing indications that the global economy is entering a period of significant realignment, disrupting the decades-long trend toward a more integrated world.

Looking toward the long-term

The way that local shocks have ramified across the globe and proven resistant to countervailing measures has begun to put the three-decade long push toward globalisation in doubt. According to the Financial Times, the data provider Sentieo has found mentions of nearshoring, onshoring and reshoring hitting their highest levels since 2005 on corporate earnings calls and investor conferences.

I’m not alone in noticing these broader shifts. Prior to the Davos summit, José Manuel Barroso, chair of Goldman Sachs International, noted that various trends – including growing tensions between the US and China – were “raising serious concerns about a decoupling world.” Agustín Carstens, head of the Bank for International Settlements, made similar comments in April, arguing that a trend toward deglobalisation, particularly when it comes to supply chains, may result in the world entering a new inflationary era. With this in mind, I would argue that focusing on short-term fluctuations in various indices will obscure the broader trajectory of the global economy.

It’s also worth thinking about how frequently we’re seeing analysts resort to longer and longer timeframes to try and explain what’s happening. Kristalina Georgieva, Managing Director of the IMF, suggested that the crisis facing the global economy may be the most significant since the Second World War. If this is the case, then we are entering uncharted waters of the kind that few investors will have seen in the course of their careers.

In these circumstances, it makes sense to turn to some of the established wisdom about investing. And where better to look than the much-vaunted status of gold as a “safe haven” asset?

Gold’s history as a risk-mitigating asset

Few commodities have exerted such a strong fascination over such a long period of human history as gold. None, certainly, have played such a varied and essential role in commercial activity.

But even though gold no longer plays a core role in the global economy, that doesn’t mean it no longer has value as an asset. As more recent history has shown, gold continues to have significant value as a result of its capacity to store value over time better than many alternatives, making it highly regarded as a hedge against inflation and the decline of the US dollar.

Gold has long been seen as a vital diversification tool for investors looking to safeguard their portfolios in turbulent times. And such an approach has been more than justified by gold’s performance through historic crises.

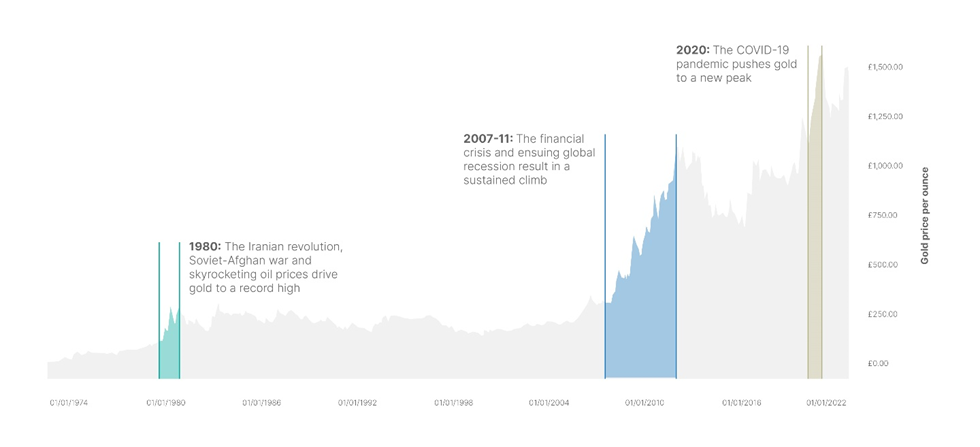

The soaring price of gold, 1974-2022

As the above chart shows, over the past forty years gold has consistently surged in times of acute global uncertainty – including in the early months of the COVID-19 pandemic. And while gold initially withdrew from its 2020 peak, it has continued to perform strongly through 2021-22. A recent FT report on investments that beat CPI from the 12 months to March 2022 showed gold outperforming other assets by a substantial margin on real returns.

Given this, it is easy to understand why many prominent financial institutions have revised their gold price forecasts upwards this year – in some cases multiple times. In January, Goldman Sachs raised its 12-month forecast to $2150 per ounce, before raising it again to $2500 in March, noting that the sanctions on Russia would likely push the country to return to buying gold once the Rouble stabilises.

It seems clear to me that the well-worn wisdom that gold is the ideal asset for mitigating risk during uncertain times continues to hold true. Given this, investors would do well to look for safe and sustainable ways to increase their exposure to gold – and this is precisely what Seventy Ninth Resources are offering.

Seventy Ninth Resources’ long-term approach to gold investments

My convictions about the value of gold and other natural resources as important parts of a secure and well-balanced investment portfolio are not new. And nor are they based solely on data – as important as this is. Over the past few years, I’ve also accumulated extensive first-hand experience in this complex and fascinating sector – including becoming certified as a rough diamond grader.

During this period, I spent a great deal of time on the ground in West Africa as part of Seventy Ninth Resources’ efforts at securing significant mining concession in the region. Thanks to an extensive process of consultation with leading experts in the sector and key local authorities, Seventy Ninth Resources has been able to secure a variety of flagship concessions in the Republic of Guinea’s Siguiri Basin, in close proximity to some of the world’s largest identified gold deposits.

As a result, Seventy Ninth Resources is now the largest owner of natural resources in West Africa, as measured by concessions under ownership and management.

This long-term commitment to seeking investment opportunities in concessions has been driven by my father Dave Webster, chairman of the Seventy Ninth Group. Dave has long been convinced of the value of gold as a risk-mitigating asset – in fact, as one of the essential foundations of the global economy. In a recent interview, he noted that “[t]he world economies rely on [gold], industry relies on it, banks rely on it. Without gold, they all shut down [almost] overnight.” For that reason, he argues that gold is “the one true currency,” maintaining its underlying value in circumstances where other seemingly stable assets can fail overnight.

As part of this recognition of the fundamental importance of gold as an asset, we’ve also sought to ensure that we cultivate secure and sustainable roots in the region where our concessions are located. Seventy Ninth Resources are committed to ensuring that our operations in the Republic of Guinea adhere to the group’s stringent Environmental, Social and Governance policies. We’re proud to have been awarded a number of internationally recognised accreditations as a result of its efforts, including becoming approved partners of the United Nations Global Compact.

This means that Seventy Ninth Resources can not only offer the perfect opportunity for investors looking to diversify their portfolios and safeguard against the prevailing climate of economic uncertainty, but also provide a way to support communities in Republic of Guinea in their efforts to secure a healthy and vibrant future. As Bill Kellaway, chairman of one of our key collaborators SRK Exploration, puts it: “I’m coming to the end of my career, and it would be great to look back and say that was the project where everybody did the right thing at the right time.”

If you’d like to learn more about the investment opportunities the Seventy Ninth Group can provide, get in touch today. With extensive experience in supporting investors to explore the value offered by gold and other natural resources, we can help you to get involved in this essential asset class.